Essentialism and Crypto

tl;dr

This article illustrates crypto's effects on the world in the coming decades. There are many polarizing opinions about what cryptocurrencies are and what they are meant to do— the purpose of this piece is to clarify why crypto exists, how it affects change, and what it will take for it to reach mainstream adoption.

I will start with two views, one from a leader in crypto (decentralized finance), and the other from a leader in traditional finance to shape the contemporary perspective.

A Crypto Evangelist

“Digital currency may be the most effective way the world has ever seen to increase economic freedom. If this happens, the implications are profound. It could lift many countries out of poverty, improve the lives of billions of people, and accelerate the pace of innovation in the world.” - Brian Armstrong (Coinbase CEO) in How Digital Currency Will Change The World

Economic Freedom is a measure of the control people have over their labor value and property. Ideals of economic freedom are closely related to healthy societies, cleaner environments, and greater human wealth per capita, to name a few. Increasing economic freedom is the mission of Armstrong and Coinbase, and he believes crypto is the answer to many humanitarian and moral issues the world faces.

A King of Traditional Finance

Warren Buffet said, if he were offered all the bitcoin in the world for 25 dollars, he would not accept the offer (worth around 700 billion dollars), but if he were offered a 1% stake in all of the apartment buildings in the US for 25 million dollars, he would sign a check on the spot.

Ouch, was my initial reaction, because I realized he is completely right. Right now crypto is a speculative asset, which means people are buying crypto because they think they can sell it for more in the future— no real-world use. During the last crypto boom, people bought crypto for the hype, not because they thought the technology would produce any cashflows, or because it had a great business model, which is the general investment thesis that has made Buffet the 5th richest man in the world (at the time of writing this article).

Buffet does not just buy stock in companies; he essentially buys entire companies. He can do this because, when he began his career, he was very good at collecting and processing company data when the tools were primal allowing him to gain capital and invest in companies for the long-term.

Which perspective will win in 10 years?

Time will tell, but the key difference in perspective is similar to the early internet— when newspaper and magazine reporters said that the internet was a novel and outlandish idea. Fast-forward to now, for better or for worse, our lives are on the internet. I see the same evolution happening with cryptocurrency because as the internet created a more efficient transfer of information, crypto is creating a more efficient and equitable transfer of value. Crypto can solve problems that will increase economic freedom, problems that the current financial system is not suited to solve.

What worked for Buffet to amass over $100 billion, will most likely not work for you.

Personally, spending a lifetime investing in companies that make sense on paper would not be worthwhile. What are you producing for the world? Whereas, technological innovations, like the internet, have furthered the boundaries of human consciousness by changing the ways people share who they are. Crypto, the next step to this, is going to change the way humans share value.

What is crypto?

Crypto exists to eliminate intermediaries in the exchange of value. In the bitcoin white paper, Satoshi Nakamoto explains bitcoin as, “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

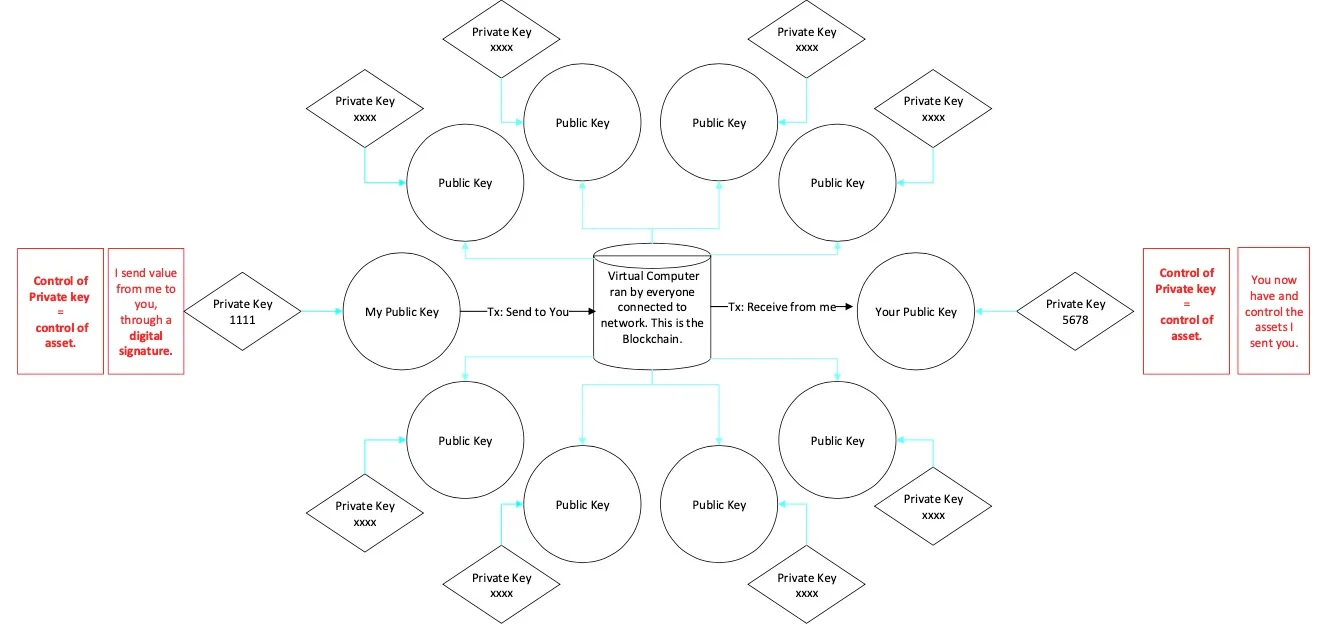

The diagram below is a visualization of crypto. The main emphasis is at the two ends in red, whoever owns the private keys, a string of letters or numbers, owns the assets. These private keys act as passwords for the public keys that interact with one another and allow me to send value from me to you. In general, buying crypto on an exchange like Coinbase, Binance or Gemini is not owning your crypto, because you do not have control over your assets-- you do not have the private key to the assets.

This diagram is the substance of crypto, but fundamentally crypto must clearly be understood as a pure peer-to-peer network to exchange value and if you own your private key then you own your assets. This is all people need to know to see the benefits.

The intricacies of how cryptocurrency works is not necessary for everyone to know. But rather, people must understand the application of the technology— the same way people do not need to understand exactly how the internet works to use it.

We have digital banking, why do we need crypto?

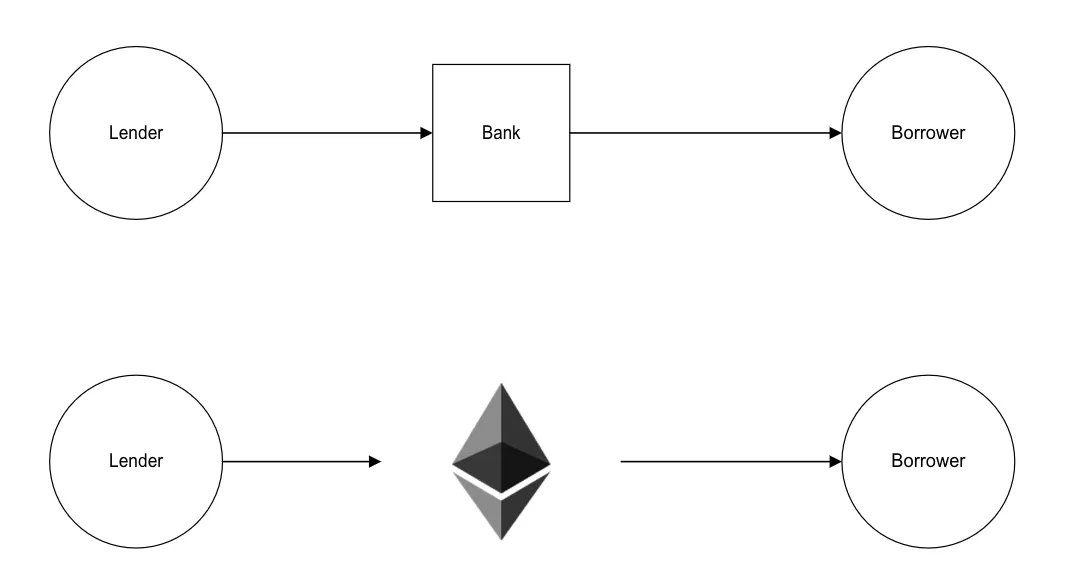

The problem with money now is that we do not own the value that our money can produce— the banks own the use of our cash. Banks use our money by lending it out and charging interest on these loans, which is how they profit. With the advent of crypto, the money that we’ve earned can be our asset, and anyone can earn their interest through Ethereum Smart Contracts. Smart Contracts are computer code that acts as the intermediary between lenders and borrowers— but do not collect fees like a bank and give the revenue to the people who are providing their cash as an asset. Again, you don’t need to understand the technical code to understand the impacts that it will have on finance.

Ethereum is the system for value— as the internet is the system for information.

How will it improve society?

This technology also eliminates the ability of governments to intervene in the money supply. In the United States, we have experienced inflation levels that are almost three times the targeted inflation levels, the highest in decades. The Central Banks have been undisciplined in their money printing and quantitative easing policies. Yet, at the same time, I still believe, as Americans, we have high levels of economic freedom relative to other countries— which allows us to weather challenging economic times.

The way that crypto will change the world is in underdeveloped economies where there is a deep distrust in the governments' effect on money and little to no access to financial services. With crypto, all we need to trust is the code, which is disciplined in its monetary policy because it’s math.

If anyone with access to the internet can use financial services, it gives financial power to entrepreneurs in underdeveloped economies, which will have an incredible impact on the world.

The Power of Entrepreneurship

Crypto is not the bread that will feed or the hand that will lift impoverished countries out of poverty. Rather, it is the tool that allows people to have a life-changing idea and then make it exist— building a business to benefit society. In impoverished countries, there are great entrepreneurs that do not have access to financial services to change their present circumstances. Crypto gives them this.

When it reaches mass adoption, Crypto will provide economic freedom and empower people to build businesses that change the world.

Why hasn’t there been an inflection point?

The problem is that in crypto, the saying, “this is the time to build,” has become a cliche. People in the space are building great apps that have real-world applications, but there isn’t mass adoption— because, unlike the internet, to engage, you need to have your money transferred from the banking system you’ve known your whole life to a new one that utilizes digital dollars. Even though the market value of your assets does not change it can still be scary— but it doesn’t have to be.

Originally, I believed crypto was not getting mass adoption because people don’t understand the blockchain. But for the past year working at Interaxis, a crypto education firm built to educate financial professionals, I’ve realized that education is not the root problem.

Rather, the issue is that people need help safely onboarding and knowing what to do once their assets are on the blockchain. People do not need to understand exactly what is “going on under the hood” with crypto, they just need to know how it affects them— which is a financial advisor's job.

Bankless Advisor

My mission is to bring the ethos of crypto to life— to increase economic freedom in the world. To that end, I have co-founded Bankless Advisor, built to onboard the world to crypto and provide advice on how to engage in crypto financial services.

The next evolution of the internet is being built better and stronger every day. We believe that people aren’t waiting for the killer app; the killer app is waiting for the people. Bankless Advisor will show the people the future is waiting for them.

At Bankless Advisor, what we are doing can change the way people look at value. We are here to protect the value that people earn and deserve by not accepting the present order of our financial system. This is not financial nihilism, but rather a demand for value to be recognized by those that produce it.

Anthony Garrett.RSS